Commercial And Home Builder Incentives in Florida: 2023 Outlook

Commercial And Home Builder Incentives in Florida: 2023 Outlook

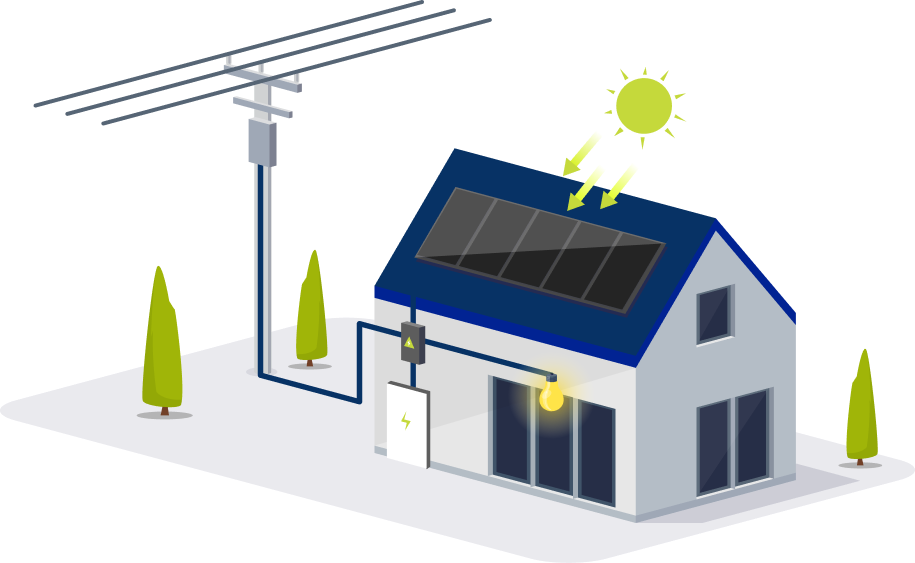

Investment in solar energy is soaring across the nation as the long-term benefits of renewable energy become more obvious. From saving on electricity bills to reducing carbon emissions, solar power is taking over as the most cost-effective, easy, and reliable source of renewable energy.

For businesses, solar energy represents the opportunity to cut overhead costs and develop a green brand image that attracts environmentally-conscious consumers. Similarly, new home construction businesses are adding solar energy amenities to their builds as the demand for solar homes increases.

Florida is a perfect state for solar energy due to the abundance of peak sunlight hours, ensuring that solar installations produce energy at a highly efficient rate. Florida experiences an average of 237 sunny days per year! However, many businesses and home builders in Florida still hesitate to take the leap and go solar, usually because of the upfront cost. As a result, the US is encouraging investment in solar energy by providing national, state and local incentives.

Commercial Solar Incentives in Florida

Federal Solar Tax Credit

This incentive allows businesses to recover 30% of their total installation costs under the 2022 Inflation Reduction Act (IRA), which aims to cut carbon emissions nationwide by 40% by 2030. As well as significantly reducing the payback period of commercial solar, the federal solar tax credit allows for a more generous return on investment, improving your bottom line.

Net Metering

Solar panels often produce excess energy during peak sunshine hours. The extra energy can be stored in solar batteries or sent back into the grid. In Florida, the energy you send back into the grid earns you renewable energy credits (RECs), the value of which is deducted from your electricity bills, increasing your long-term savings. If the amount you’ve saved is larger than your utility energy consumption, your utility company will pay you the remaining amount at the end of the 12-month billing period.

JEA Battery Incentive Program

The Jacksonville Electric Authority provides businesses that meet the requirements laid out in the statute with up to $4000 in rebates for installing solar energy storage.

Modified Accelerated Cost-Recovery System (MACRS)

Businesses can recover a portion of their investment in solar installation through annual deductions provided by this tax depreciation system.

Home Builder Incentives in Florida

Energy-Efficient New Homes Tax Credit for Home Builders

With this incentive, home builders can receive up to $2,500 for a construction project meeting the requirements in the statute. The IRA (Inflation Reduction Act) has adjusted the provisions of this incentive to provide additional incentives of up to $5000 for home builders who pay prevailing wages to those laborers and engineers in the construction project.

Get Cost-Effective Solar Solutions That Meet Your Needs

Commercial and new construction solar energy is an excellent investment that pays off in the long run, but to maximize your savings, you must make sure you’re choosing the most cost-effective and high-quality installation that meets your budget and needs. IE Construction can help you there. We understand the complexities of commercial and new construction solar and are fully equipped to help you get the turnkey solar solutions you’re looking for. Whether you’re looking for attractive financing options, top-quality materials, or incentives, our energy advisors have years of experience to help you. Ready to invest in solar energy in Florida? Contact us today to learn how IE Construction can help you go solar.